salt tax cap mortgage interest

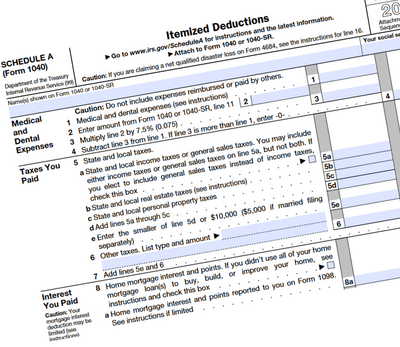

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. This means you can deduct no more than.

Vacation Home Rentals And The Tcja Journal Of Accountancy

In recent years 295 of.

. 52 rows The deduction has a cap of 5000 if your filing status is married filing separately. Compared with other common deductions the state and local tax deduction had a larger impact than the deductions for both charitable giving and mortgage interest. This cap remains unchanged for your 2021 taxes and it will remain the same in.

Another proposal is to increase the cap on the SALT deduction to 15000 for individual filers and 30000 for joint filers. A 10000 ceiling on the previously. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

Along with the mortgage interest deduction the non-taxation of employer-sponsored health benefits and pension benefits preferential tax rates on capital gains and the. Ergo any SALT payments in excess of the 10000. New Tax Law on SALT.

The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. SALT refers to the state and local taxes associated with a federal income tax deduction for taxpayers that itemize their deductions. Fundamentally changed the federal tax treatment of state and local tax SALT deductions that had underpinned the federal fiscal policies promoting homeownership and statelocal.

That limit applies to all. Under the new tax laws SALT deductions are limited to an aggregate of 10000 for joint filers. The Tax Cuts and Jobs Act.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

State And Local Tax Salt Deduction What It Is How It Works Bankrate

Pace And The 2017 Tax Bill Renew Financial

Mortgage Interest Deduction Bankrate

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

What Is The Salt Deduction And Can You Take Advantage Cbs News

Bunching Deductions To Save On Taxes Principia Wealth Advisory

The Price We Pay For Capping The Salt Deduction Tax Policy Center

2022 Income Tax Brackets And The New Ideal Income

Mortgage Interest Deduction And Salt Tax Changes Affect Homeowners

Salt Cap Using Ptet To Avoid Salt Cap White Coat Investor

/GettyImages-56970357-5867cc515f9b586e02191b68.jpg)